Atmanirbhar Haryana Loan: Amidst the most adverse impacts of the COVID-19 pandemic affecting the poorest and economically vulnerable citizens, the Haryana government has launched the Atmanirbhar Haryana loan Yojana. Under this initiative, small businesses in the state are provided with loans to establish their own micro-enterprises. Beneficiaries of the state government’s scheme receive financial assistance of Rs. 15,000 as a loan to kickstart their small businesses. Through the Aatmnirbhar Haryana Loan Yojana 2024, approximately 3 lakh economically weaker citizens of the state will have access to loans at an interest rate of only 2% to initiate their own small businesses

Atmanirbhar Haryana Loan Yojana 2024

Initiated by Chief Minister Manohar Lal Khattar, the Atmanirbhar Haryana Loan Scheme is another integral part of the “Aatmanirbhar Bharat Abhiyan” launched by the central government. Under this scheme, citizens of the state are encouraged to establish self-employment ventures and become self-reliant. Through this initiative, the state government aims to assist economically disadvantaged individuals who have lost their livelihoods due to the Covid-19 pandemic and now aspire to start their own small businesses. Under the DRI scheme of the Haryana government, loans are provided to the state’s poor citizens at a 4% interest rate, while beneficiaries under the Atmanirbhar Haryana Loan Yojana 2024 will receive loans for starting their own small businesses at only a 2% interest rate, with the remaining 2% interest borne by the state government.

Today, through this article, we will provide you with all the essential information related to the Atmanirbhar Haryana Loan Yojana. We will cover aspects such as objectives, benefits, features, eligibility criteria, required documents, application process, and more.

Overview of Atmanirbhar Haryana Loan Scheme

| Scheme Name | Atmanirbhar Haryana Loan Yojana |

|---|---|

| Initiated By | Chief Minister Manohar Lal Khattar |

| Year | 2024 |

| Beneficiaries | Poor and Small Entrepreneurs in the state |

| Application Process | Online |

| Objective | To encourage citizens to establish self-employment ventures |

| Benefits | Financial assistance in the form of a loan of ₹15,000 |

| Category | Haryana Government Schemes |

| Official Website | https://atmanirbhar.haryana.gov.in/frontend/web/ |

Objective of Atmanirbhar Haryana Yojana 2024

The primary objective of the Atmanirbhar Haryana Loan Scheme, initiated by the Haryana state government, is to empower economically disadvantaged and unemployed small traders who have been rendered jobless due to the global pandemic, COVID-19, to become self-reliant and resilient once again. Through this scheme, citizens of the state will be encouraged to establish their own small self-employment ventures, and they will also be provided financial assistance in the form of loans to establish self-employment.

Under this initiative launched by the state government, beneficiaries will receive financial assistance of ₹15,000 as a loan with a 2% interest rate to facilitate the establishment of their self-employment ventures. Additionally, approximately 300,000 citizens of Haryana will benefit from this scheme, and the loan amount will be directly transferred to their bank accounts.

The Atmanirbhar Haryana Loan Scheme aims to revitalize the economy by promoting self-employment among those affected by the pandemic and fostering self-sufficiency and entrepreneurship in the state’s populace.

Table of Contents

Benefits and Features of Atmanirbhar Haryana Loan Yojana

- Initiative Introduction:

- The Atmanirbhar Haryana Scheme 2024 was inaugurated by the Haryana state government.

- Its primary goal is to encourage economically weak and financially vulnerable citizens to establish small self-employment ventures.

- Inspiration and Objectives:

- Inspired by the central government’s Aatmanirbhar Bharat initiative, the scheme aims to provide impetus to self-reliance.

- Beneficiaries of the scheme are offered loans at an attractive interest rate of just 2%, facilitating the establishment of self-employment opportunities.

- Financial Assistance:

- Under the scheme, eligible citizens receive financial aid of ₹15,000 as a loan to initiate small-scale self-employment ventures.

- The loan amount is directly transferred to the beneficiaries’ bank accounts by the state government.

- Loan Categories and Interest Rates:

- Three types of loans are available under the scheme: DRI loans, Mudra loans for micro-enterprises, and education loans.

- The state government offers loans to economically disadvantaged citizens at a nominal interest rate of 4% under the DRI scheme. However, under the Atmanirbhar Haryana Loan Scheme, beneficiaries enjoy a reduced interest rate of 2%, with the remaining 2% borne by the state government.

- Initiative Impact and Reach:

- Chief Minister Manohar Lal Khattar initiated the scheme with the aim of benefiting nearly 300,000 economically weak individuals.

- The scheme’s implementation is anticipated to create ample employment opportunities, fostering economic growth and prosperity in the region.

- Online Application Process:

- Citizens can conveniently apply for scheme benefits through the official portal at atmanirbhar.haryana.gov.in.

- The online application process eliminates the need for individuals to visit government offices, saving time and resources while ensuring transparency in the system.

Atmanirbhar Haryana Yojana 2024 Eligibility Criteria

- Residency Requirement:

- Interested individuals must be permanent residents of Haryana state to qualify for benefits under the Atmanirbhar Haryana Loan Scheme 2024.

- Online Application Process:

- Applicants are required to submit their applications online through the atmanirbhar.haryana.gov.in portal to avail themselves of the scheme’s benefits.

- Bank Defaulters Exclusion:

- Individuals who are identified as defaulters by any bank will not be considered eligible for the scheme. It is imperative for applicants to maintain a clean financial record to qualify for the scheme.

Required documents for Atmanirbhar Haryana Loan Yojana

- Aadhaar Card of the applicant.

- Residential Proof Document.

- Residence Certificate.

- Identification Document.

- Bank Account Details.

- Passport-sized Photograph.

- Mobile Number.

Application Process under Atmanirbhar Haryana Loan Yojana 2024

Interested citizens of Haryana state who want to apply for availing benefit under Atmanirbhar Haryana Loan Scheme, they have to apply through atmanirbhar.haryana.gov.in portal. Through this scheme three types of loans are provided under bank loan:- DRI, Shishu Loan and Education Loan under Mudra, out of which you have to follow the following instructions to get any one loan as per your requirement.

Application Process for DRI Yojana

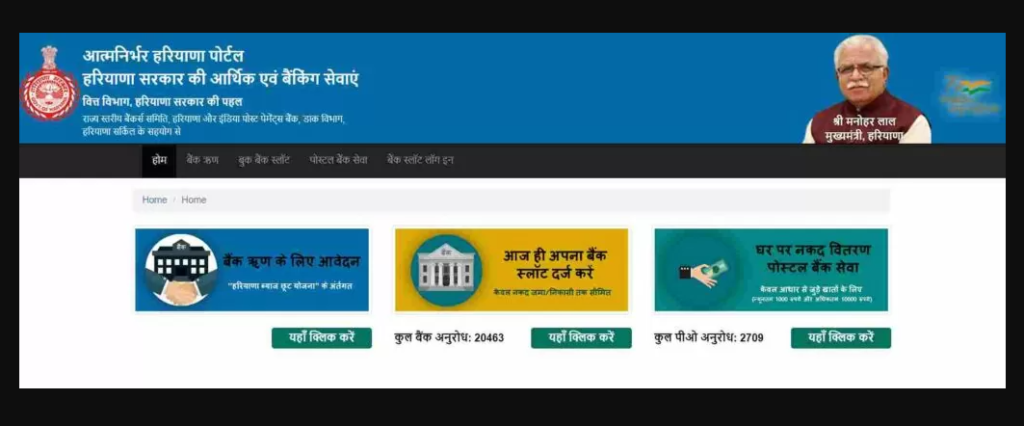

First of all you have to visit the official website of Atmanirbhar Haryana Yojana. Now the homepage of the website will open in front of you.

On the home page of the website you have to click on the option of “Apply for Bank Loan”. After this a new page will be displayed on your screen|

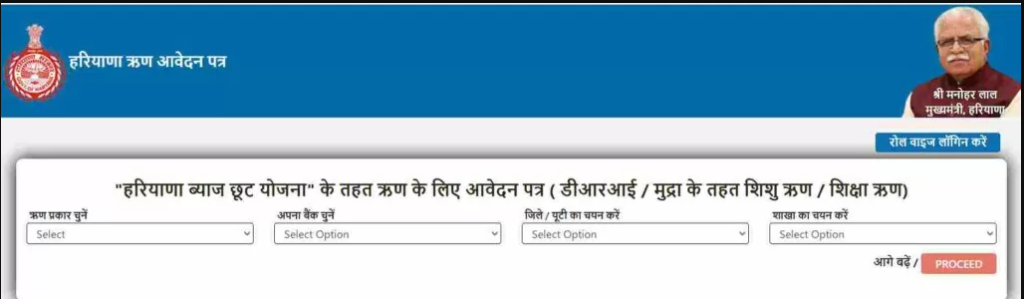

- Click on the option “Choose Loan Type” on this new page.

- A dropdown box will appear. Click on the option “DRI Loan” among the various loan options provided.

- Enter your bank, district, and branch details.

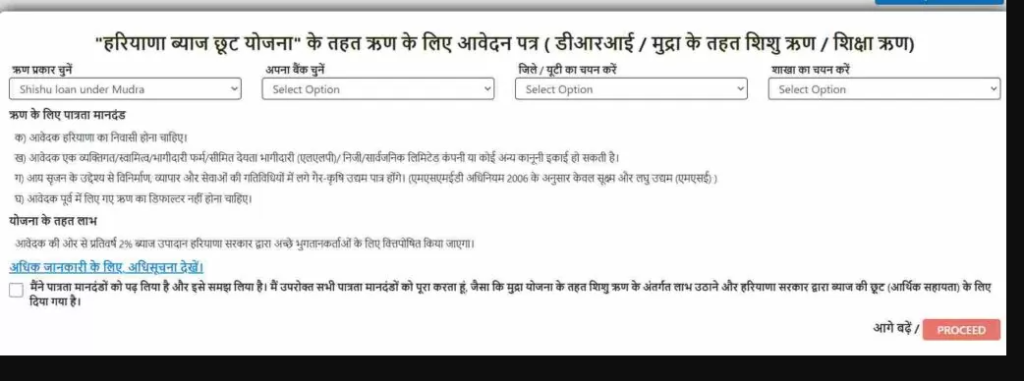

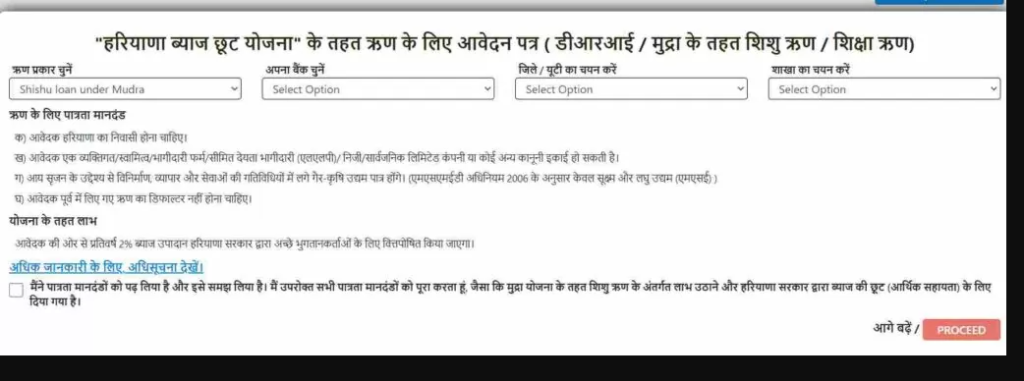

- Carefully read all the eligibility criteria (interest rate) and information related to the loan under the DRI scheme.

- Click on the checkbox for “I have read and understood the eligibility criteria and am willing to fulfill all the eligibility criteria for availing the benefits of the Haryana government’s DRI scheme and interest waiver, as mentioned above.”

- Click on the option “Proceed.”

- A new page will open where you need to enter details related to your Aadhaar number.

- Click on the option “I agree to share information related to my Aadhaar number and family identity card for applying for a DRI loan under the Haryana Interest Waiver Scheme.”

- Now, as per your convenience, either opt for “Validate through Biometrics” or “Validate through OTP” to verify your Aadhaar.

- After verification, your application will be complete.

Application Process for Child Loan under Mudra

- Go to the official website of the Atmanirbhar Haryana Loan Scheme.

- The homepage of the website will appear.

- On the homepage, click on the option “Apply for Bank Loan”.

- A new page will be displayed on your screen.

- On this new page, click on the option “Choose Loan Type”.

- A dropdown box will appear.

- In the dropdown box, click on the option “Shishu Loan under Mudra Yojana” among the various loan options provided.

- Enter your bank, district, and branch details.

- After that, carefully read all the eligibility criteria and information related to the loan.

- Click on the box that says, “I have read and understood all the eligibility criteria, and I fulfill all the above eligibility criteria as provided by the Mudra Yojana for availing the benefits under the Shishu Loan and the interest subsidy (financial assistance) provided by the Haryana government.”

- Click on the option “Proceed” to move forward.

- A new page will appear where you need to enter your Aadhaar number details.

- After entering the Aadhaar details, click on the option that states, “I agree to share my Aadhaar number and family identity card information for applying for the DRI loan under the Haryana Interest Subsidy Scheme.”

- Choose either “Authenticate via Biometric” or “Authenticate via OTP” based on your preference to verify your Aadhaar.

- After Aadhaar verification, your application will be complete

Application Process for Education Loan

- Visit the official website of the Atmanirbhar Haryana Scheme.

- On the homepage of the website, click on the option “Apply for Bank Loan.”

- A new page will appear on your screen.

- On this new page, click on the option “Choose Loan Type.”

- A drop-down box will appear.

- In this drop-down box, select the option “Education Loan.”

- Enter details of your bank, district, and branch.

- Then, carefully read all the eligibility criteria for the loan.

- Click on the box stating, “I have read and understood all the eligibility criteria and agree to fulfill all the criteria for availing benefits under the Haryana government’s education loan and interest subsidy scheme.”

- Proceed by clicking on the option “Continue.”

- A new application form will open.

- Fill in all the required details such as applicant’s name, organization name, loan account number, etc.

- Click on the option “Declaration.”

- Preview your application form, and then click on “Submit and Proceed.”

- Click on the option “Submit” to complete your application for the education loan.

- National Overseas Scholarship 2024: How to Apply, Eligibility, and Deadline

- Free Solar Power For Farmers: Everything You Need To Know About PM Solar Panel Yojana 2024

- How To Apply For PM Home Loan Subsidy Yojana 2024 Online

- Official website Madhya Pradesh Government