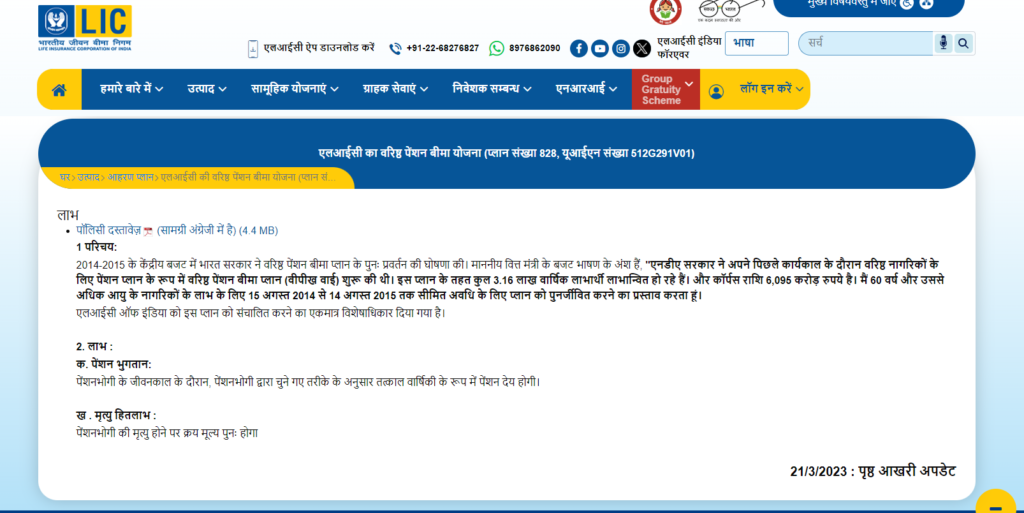

LIC Varishtha Pension Bima Yojana | LIC Senior Pension Insurance Scheme Application | LIC Varishtha Pension Bima Application Form | LIC Senior Pension Insurance Registration | LIC Senior Pension Insurance Scheme 2023

Many life insurance policies have been taken out for the citizens of our country so that people can get financial support. Similarly, among these insurance schemes, LIC Senior Pension Insurance Scheme has been launched for the senior citizens of the country through LIC

So today we are going to give you all the information related to LIC Varishtha Pension Bima Yojana 2023 like what is its purpose and what is the eligibility for application, what are its benefits, what are the documents and what is the application process.

Varishtha Pension Bima Yojana

LIC Senior Pension Insurance Scheme is a type of insurance policy through which citizens have to pay only one time premium. This premium can be paid by the citizen on quarterly, half-yearly or yearly basis and the benefit of this scheme is extended for the whole life after paying one-time premium. A lock period of 15 days has been given by Varishtha Pension Bima Yojana. If any citizen is dissatisfied with the Senior Pension Insurance Scheme during this period, they can withdraw their funds within 15 days to sustain themselves adequately due to extreme poverty.

Overview of LIC Varishtha Pension Bima Yojana

| Feature | LIC Senior Pension Plan |

|---|---|

| Name | LIC Senior Pension Plan |

| Year Started | 2023 |

| Started by | Government of India |

| Department | Life Insurance Corporation of India |

| Beneficiaries | Senior citizens of India |

| Objective of the plan | To provide pension to senior citizens of India |

| Benefits of the plan | The plan offers a fixed return of 9.3% |

| Application type | Offline |

| Official website | http://www.licindia.in/ |

Objective of LIC Varishtha Pension Bima Yojana

As we all know, there are many senior people in our country who are unable to live their lives properly due to being very poor. Keeping all these things in mind, the Government of India has started the Senior Pension Insurance Scheme. Through this scheme, pensions will be provided to all senior citizens in our country, enabling them to enhance their quality of life and live with dignity. Through this scheme, not only will they be able to live their lives properly and they will also become self-reliant and empowered.

Table of Contents

Loan under LIC Varishtha Pension Bima Yojana

The beneficiary can avail loan against investment up to 75% under Senior Pension Insurance Scheme in case of any need. This loan can only be accessed after three years of obtaining the beneficial policy.. The interest rates on loans taken under LIC Senior Pension Insurance Scheme have been determined separately by the Life Insurance Corporation of India.

Policy of LIC Varishtha Pension Bima Yojana

Under LIC Varishtha Pension Bima Yojana, the duration of this policy has been fixed at 15 years, if the policyholder does not withdraw money from the policy for the full 15 years, then the entire purchase price will be returned to the policyholder. If the policyholder needs to withdraw the money before 15 years for any reason, only 98% of the purchase price will be refunded to them.

How does the Senior Pension Insurance Scheme work?

- If the policy holder dies, the purchase price is returned.

- Loan can be availed only after the policy holder completes 3 years.

- Senior Pension Insurance Scheme can be purchased by the pensioner at the purchase price.

- The policy holder will have to make a lump sum payment to purchase this plan.

- The pension amount will be provided monthly, quarterly, half-yearly or annually to the pensioner.

- Pension will also be payable to the family of the policyholder.

- The minimum and maximum amount of the policy has been fixed.

- Policy holders will have to pay interest on the loan.

- If the policy holder does not continue with the plan for any reason, the policy holder will have to repay the loan amount in full before exiting the policy.

Main facts of Senior Pension Insurance Scheme

- Family Benefit: Under this plan, the policy amount can be received by the spouse or dependent family member.

- Purchase Price: This plan can be purchased by paying a lump sum purchase price. There are different types of purchase prices under the Senior Pension Insurance Scheme. The pensioner can choose the purchase price and pension amount according to his financial condition.

- Age Limit: The minimum age limit under this scheme is 60 years and there is no maximum age limit.

- Surrender Value: The pensioner can withdraw from the scheme on completion of 15 years of the policy term. In this case 100% of the purchase price will be refunded to the pensioner. But if the pensioner withdraws from the scheme before 15 years, only 98% of the purchase price will be refunded.

- Pension Payment: Pension under Senior Pension Insurance Scheme will be paid based on the mode of pension payment selected. The first pension will be paid after 1 month, 3 months, 6 months or 1 year of purchasing the policy.

- Free Look Period: Under this scheme there is a free look period of 15 days. If the policy holder is not satisfied with the guidelines of this policy, he can exit this policy within 15 days. In this case, the entire amount of purchase price will be refunded after deducting stamp duty.

- Loan: After completion of 3 years of the policy term, a maximum loan of 75% of the purchase price can be availed. Interest will have to be paid on this loan.

- In case of death: If the pensioner dies, the purchase price provided under the scheme will be refunded.

Features of LIC Varishtha Pension Bima Yojana

- Varishtha Pension Bima Yojana has been started by Life Insurance Corporation of India for the senior beneficiaries of the country.

- The return rate of this scheme has been fixed at 9.3%.

- To avail the benefits of this scheme, the citizen will not need to undergo any kind of medical checkup.

- Through this policy the applicant will have to invest for 15 years.

- If someone withdraws money before 15 years, he will be given money at the rate of 98% of the purchase price.

- Through this scheme, a citizen can take a loan up to 75%.

- The lock period of this scheme is 15 days.

- If a citizen is not satisfied with the Indian scheme, he can return the policy within 15 days.

- The fast money of LIC Varishtha Pension Bima Yojana will be sent directly to the citizen’s bank account.

- Tax exemption will also be given under Section 80 CCC of the Income Tax Act.

- If the policy holder dies during this period, the purchase price will be given to the nominee.

Eligibility and documents for LIC Varishtha Pension Bima Yojana

- It is mandatory for the applicant to be a permanent resident of India.

- Applicant must be above 60 years of age

- Aadhar card

- Ration card

- Address proof

- age certificate

- passport size photograph

- mobile number

Process of application under LIC Varishtha Pension Bima Yojana

Interested senior citizens of the country who want to apply under LIC Varishtha Pension Bima should follow the steps given below.

- First of all you have to go to your nearest LIC office.

- After going to the office, you will have to ask for the application form from here.

- After receiving the application form, you have to enter all the information asked in it carefully.

- After entering the information you have to attach all your important documents.

- After attaching the document, you have to submit this form in the same LIC office

- Along with the application form, you will also have to deposit the premium amount.

- In this way you can apply under this scheme.

- Contact Helpline – 022 6827 6827